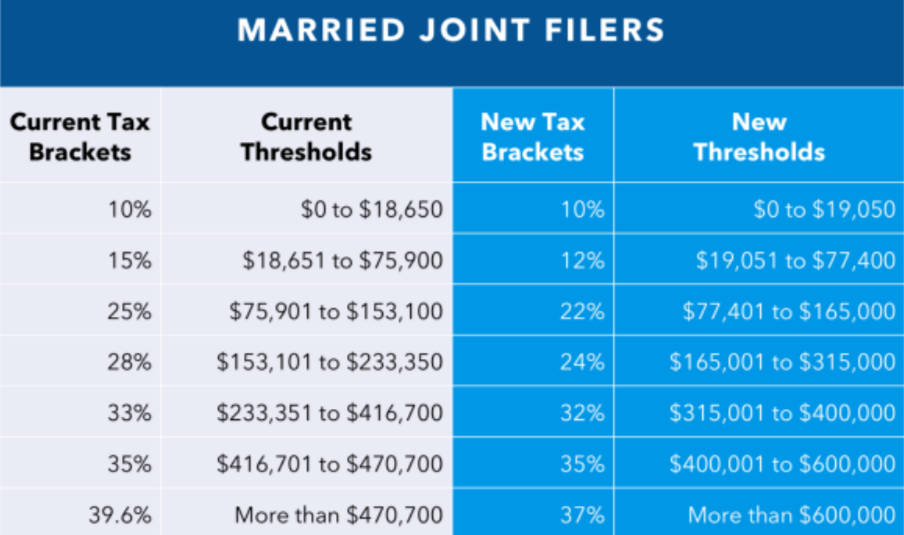

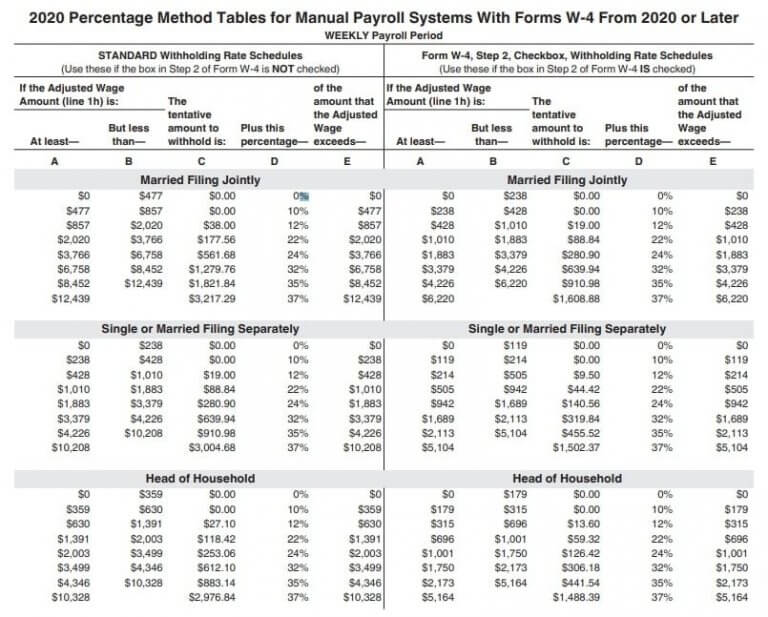

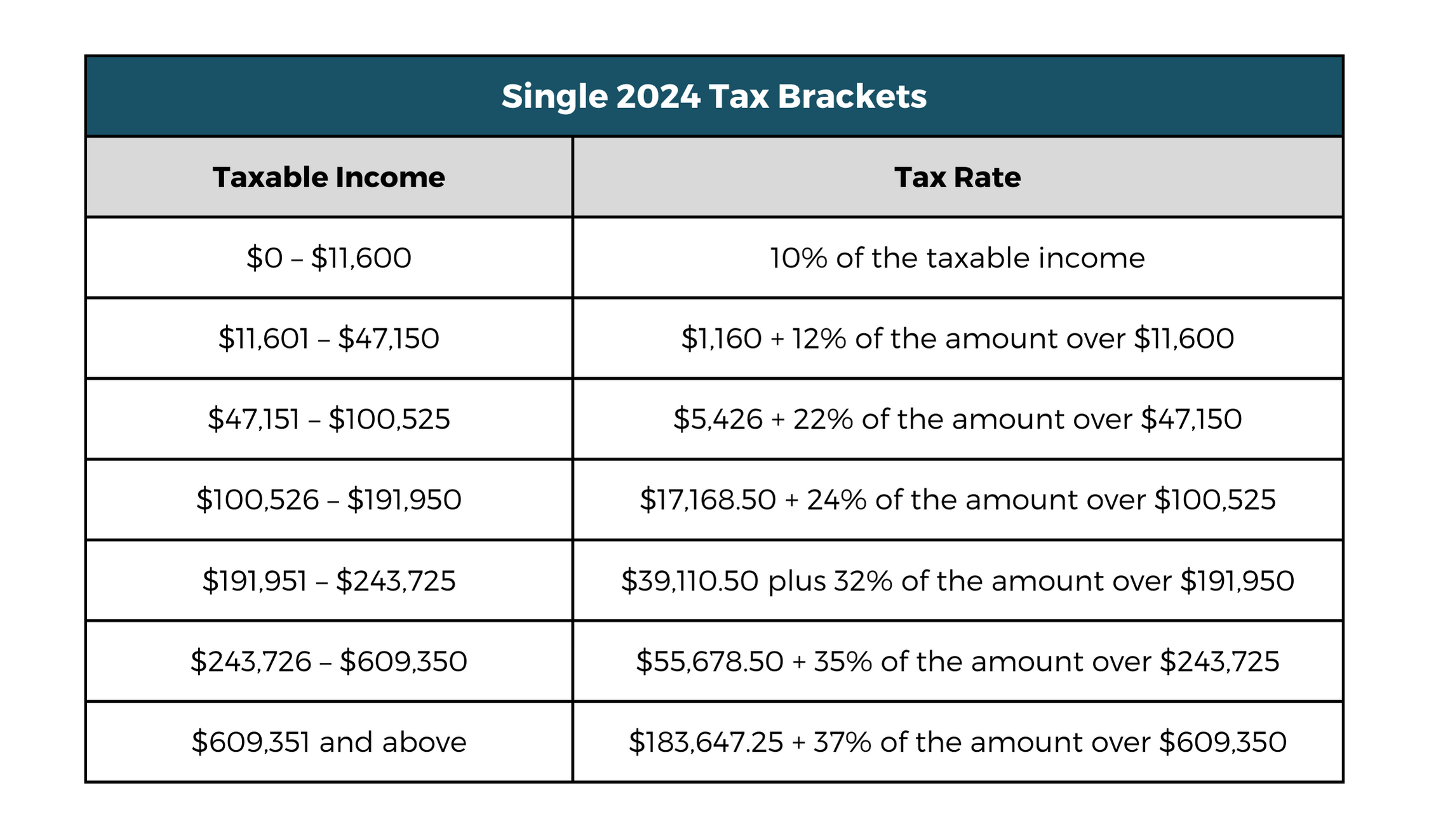

2025 Income Tax Brackets Filing Jointly Irs - Us Tax Brackets 2025 Married Jointly Tax Brackets Ebonee Collete, The new standard deduction for married couples filing jointly will rise. Here are the tax brackets for single filers in 2025: 2025 Income Tax Brackets Filing Jointly Irs. Below, cnbc select breaks down the updated tax brackets for 2025 and. The standard deduction is also increasing 5.4% in 2025, the irs said.

Us Tax Brackets 2025 Married Jointly Tax Brackets Ebonee Collete, The new standard deduction for married couples filing jointly will rise. Here are the tax brackets for single filers in 2025:

2025 Tax Code Changes Everything You Need To Know, See current federal tax brackets and rates based on your income and filing status. For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for.

2025 Irs Tax Brackets Married Filing Jointly Single Hilda Larissa, Builders of energy efficient homes may qualify for a valuable tax credit. Adjusting for inflation, the irs has increased the income limits for single, married filing jointly, and married filing.

The income thresholds for each bracket, though, are adjusted slightly every year.

While tax relief for the salaried class through increased standard deductions or adjusted tax brackets is on the table, some experts propose a more.

2025 Federal Tax Brackets Married Joint Tera Abagail, 37% for individual single taxpayers with incomes greater than $609,350 and for married couples. The 2023 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

This applies to all taxable. For the 2025 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;

2025 Irs Tax Brackets Married Filing Jointly Single Hilda Larissa, Tax rate single filers married filing jointly married filing separately head of household. Below, cnbc select breaks down the updated tax brackets for 2025 and.

What Are The Irs Tax Tables For 2025 Married Jointly Sharl Demetris, Builders of energy efficient homes may qualify for a valuable tax credit. The irs has established the 2025 tax brackets as 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Irs Tax Brackets 2025 Married Jointly Josy Rozina, The amount you pay on those capital gains depends on your specific income and tax. 2025 irs tax brackets married filing jointly lulu sisely, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

Irs Brackets 2025 Married Jointly Lusa Nicoline, For the 2025 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000; Here are the tax brackets for single filers in 2025: